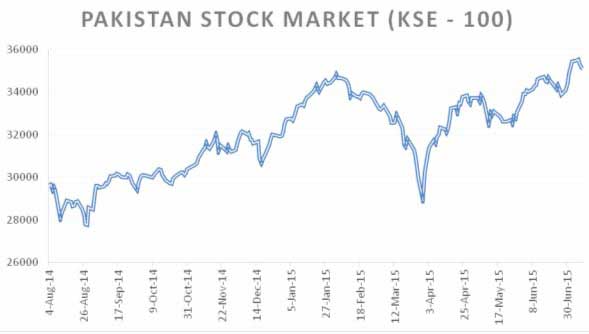

Pakistan Stock Market (KSE-100) 1990-2015 decreased to 35147.13 Index points in July 9, 2015 from 35,328.83 Index points in the previous trading day. Stock market in Pakistan averaged 7691.91 Index points from 1990 until 2015, reaching an all-time high of 35,537.69 Index points in July of 2015 and a record low of 538.89 Index points in June of 1990.

Below is the latest graph showing impressive growth in the Pakistan stock market (KSE-100)

Pakistan’s capital market should continue its top most position in the years ahead. It should qualify among the world’s most transparent and fair markets, providing the best opportunities to the investors. The management has already embarked on implementing a long- lasting reforms agenda for the capital market primarily focusing on strengthening of the market monitoring and enforcement regime and introduction of structural reforms for market development and its outreach.

Pakistan and Bloomberg Investor Group held detailed deliberations about economic revival of Pakistan. The Bloomberg Investment Group has expressed satisfaction over the reform agenda followed by the current government for economic revival. It has appreciated policies and reforms agenda being followed by the government.

The Finance Minster has always highlighted investment-friendly environment created by the government by pursuing policies to attract more foreign direct investment in different sectors in Pakistan. The government’s reforms agenda is based on 4Es, i.e. economy, energy, extremism and education/health (social sector). The above-mentioned four sectors are being addressed on priority.

The growth rate is improving, the inflation is expected to come down, capital market is performing better and the currency has gained stability. The government is committed to increase education budget from 2 to 4 per cent in next two years. Government is planning new global bond and sukuk issues in 2015-2016 and is ready for 7th IMF review, which never had happened before. Investors are showing keen interest in the economic performance of the country.

The year 2014 was a year of momentum growth for the Pakistani capital market. Throughout the year, the benchmark KSE-100 Index of the Karachi Stock Exchange Limited (KSE), showed excellent performance and touched landmark, unmatched levels in terms of value and volume. The market continued with the same momentum this year too as it set all-time trading record before the Eid holidays and now after the break it set another record-high mark.

According to Bloomberg, Pakistan ranked third in 2014 amongst the Top Ten Best Performing Markets in the world. Also, Pakistan has been able to secure a place amongst the Top Ten for the third consecutive year now. Moreover, in the MSCI Asian Frontier Markets, Pakistan ranked number one – outstripping Sri Lanka, Vietnam and Bangladesh by a huge margin.

In 2014, the KSE-100 Index gained 6,870 points generating a handsome return of 27 per cent (31 per cent return in US$ terms). Total offerings in the year 2014 reached 9 as compared to 3 in the year 2013. After a gap of seven years, Rs73 billion were raised through offerings in 2014 as compared to a meager Rs4 billion raised in 2013.

Higher foreign inflows during the year can also be counted as a major market momentum. Foreign investors, that hold US$6.1 billion worth of Pakistani shares – which is 33 per cent of the free-float (9 per cent of market capitalization) – remained net buyers in 2014.

This positive performance of the capital market can be due to a number of favorable factors, both at the political and economic front. As mentioned above, substantial foreign investments in the equity markets, which captured considerable free float of the market, declining dollar-rupee disparity and Government of Pakistan’s secondary market offerings played a major role.

Other key factors, which can be seen as contributing to the market’s bull-run are Government’s business friendly reforms, improved macro-economic indicators including record foreign exchange reserve levels increased confidence shown by international donor agencies, government’s energy sector initiatives, significant interest shown by China to invest in Pakistan and government’s plans and initiatives towards fast-track privatization

Karachi Stock Exchange (KSE-100) Index over the last 12 months, featured among the world’s top 10 performers, said Bloomberg News in its latest report on Pakistan’s economy. The report highlighted improvement in Pakistan’s economic performance in terms of trade, investment, industry, inflation, construction and growth during the present government. The report noted that Prime Minister Sharif, who took power in May 2013, has boosted infrastructure spending by 27 per cent to Rs1.5 trillion for the fiscal year starting from July 1.

Pakistan was making ‘significant progress’ in meeting targets under its $6.6 billion loan program, the International Monetary Fund (IMF) said in May. The lender predicted a 4.5 per cent growth in the economy in the year starting July 1, following a 4.1 per cent expansion in the last fiscal year. According to the report, easing prices are also set to buoy consumer spending. Inflation in South Asia’s second-largest economy slowed each month this year through April as transport and food prices fell, prompting the central bank to cut the benchmark interest rate in May to the lowest level in 42 years.

Moody’s Investors Service (MIS) upgraded Pakistan’s sovereign credit ratings for the first time since 2008 in June. China stood by Pakistan as the nation’s long-time strategic ally. In April, Asia’s biggest economy, China, signed deals for $28 billion of investments in Pakistan as part of a planned $45 billion economic corridor that includes power plants and dams.

The nation’s construction sector grew by 11.3 percent in the year through June 2014, almost double the target, according to central bank data. Pakistan is a reform story like neighboring India’s, but only better, said Renaissance’s Robertson. “All of this is a big change on 2013,” he said. “Credit rating agencies are beginning to recognize this.” The government averted a balance-of-payments crisis with help from the IMF and resumed selling stakes in state companies.

More IPOs

D. G. Khan Cement Co, controlled by billionaire Mian Muhammad Mansha, and Cherat Cement Co has announced expansion plans, while steel-makers are selling shares. Amreli Steels Ltd, the nation’s biggest maker of steel bars used in construction, is planning a share sale to help double capacity. Mughal Iron and Steel Industries Ltd completed an initial public offering in April.

Pakistan’s cement industry has 57 per cent in the past year, more than triple the gains by the benchmark, according to data compiled by Bloomberg. D. G. Khan Cement, the third-largest maker of the construction material, has jumped 62 per cent and Maple Leaf Cement Factory Ltd has surged 161 per cent and Fauji Cement Co Ltd has gained 81 per cent.

Renowned economist of The Morgan Stanely in his lecture at Aga Khan University Karachi said that Pakistan with a 200 million population including 100 million below 30 years of age, would soon achieve the goal of economic development. He said Pakistan was included among the nine countries of Asia, which can achieve extraordinary development on the pattern of China. It can play important in the global economy in the coming decades.

PAGE Blog Business Weekly Magazine

PAGE Blog Business Weekly Magazine