Karachi Stock Exchange (KSE) has remained focus of investors, both local and foreign. Some analysts attribute this to the long history, offering ease in trading and diversity of scrips offering attractive return. But there is a consensus that deployment of technology, offering smooth and efficient settlement system and above all creation of paperless environment facilitates for investors from all over the country to trade through KSE.

Pakistan’s capital market has grown modestly but consistently. Despite various limitations and hurdles local capital market has played a vital role in enabling private and public sector to mobilize huge funds. It is estimated that during last one decade the total amount of equity and debt raised through local bourses is about one trillion rupees. Out of this, the Government of Pakistan (GoP) mobilized Rs170 billion through offering of shares of public sector enterprises. This offering helped in coining a new term ‘Privatization for people’ because the ultimate beneficiary of this process has been people of Pakistan.

According to Nadeem Naqvi, Managing Director, Karachi Stock Exchange, “If the debt market is developed, there is no reason why an enormous amount of savings (both domestic and international can’t be tapped for infrastructure and industrial development by the public and sector.)”

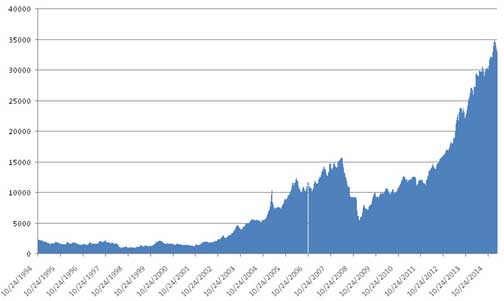

Reportedly market capitalization touches US$71 billion it is still dismal because market cap/GDP ratio is just 30% as compared to 46% in April 2008. Pakistan market has been among the top five best performing stock markets of the world for the last five years.

Highest return

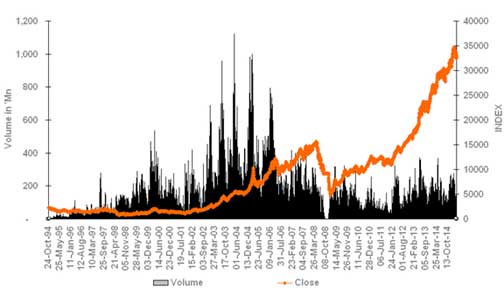

While there are many investment options available in the country over the last ten years, KSE-100 Index has offered the highest return of over 26%. Gold offered nearly 13% return, return on PIBs and T-Bills has been 11.35 and 10% respectively as against a return of 4.5% on bank deposits. In the recent past earnings of banks have increased and NPL reduced mainly because of huge investment risk free government securities, also offering attractive rate of return.

It has been reported in the media that foreign portfolio now constitute significant percentage of listed capital. It is worth mentioning that foreign portfolio inflow increased to US$676 million during FY14 from US$569 million during FY13.

One of the reasons for renewed interest of investors in stock market has been the increasing percentage of dividend distributing companies. The percentage increased to 44% in 2013 from 39% for 2010. This positive development is due to a number of reasons that include: 1) supporting business environment and 2) strong economic fundamentals but another reason in reduction in the number of listed companies though voluntary liquidation.

Another reason for rising investment in equities market is efficient risk management. For investors’ protection following measures have been taken: 1) focus on improving quality of services being offered and improving capacity, 2) imposition of substantial financial penalty and personal accountability, 3) proactive risk management approach, 4) empowering the investors and 5) creation of investor protection fund. Along with this a systemic risk mitigation system has been introduced that include: 1) market utility, 2) robust margining regime, 3) trade settlement guarantees and 4) creation of clearing house protection fund.

Lesson of 2008 crisis

Equity market crisis of 2008 many lessons to investors, brokers and even regulators. The general perception is that the blame for 2008 crisis goes to SECP and even management of KSE could be held responsible for not taking timely decisions and becoming subservient to the regulators. In the post 2008 era efforts have been made to strengthen regulatory regime and the measures taken include: 1) introduction of strong risk management system and creation of state-of-the-art technology based trading platform, 2) ensuring seamless electronic integration of trading at KSE, clearing and settlement through NCCPL and custody at CDC, 3) introduction of fit and proper criteria for brokers to know your customer and implementation of anti money laundering guidelines. The point worth mentioning is that over Rs800 million were paid from investor protection fund of KSE to investors affected by 2008 financial crisis, with 50% of claims fully settled.

PAGE Blog Business Weekly Magazine

PAGE Blog Business Weekly Magazine